During the LIVE WEBINAR Baltic Sea Offshore Wind 2024 Outlook, key figures in the European energy sector discussed the progress and hurdles faced in expanding offshore wind energy, particularly focusing on the Baltic Sea region.

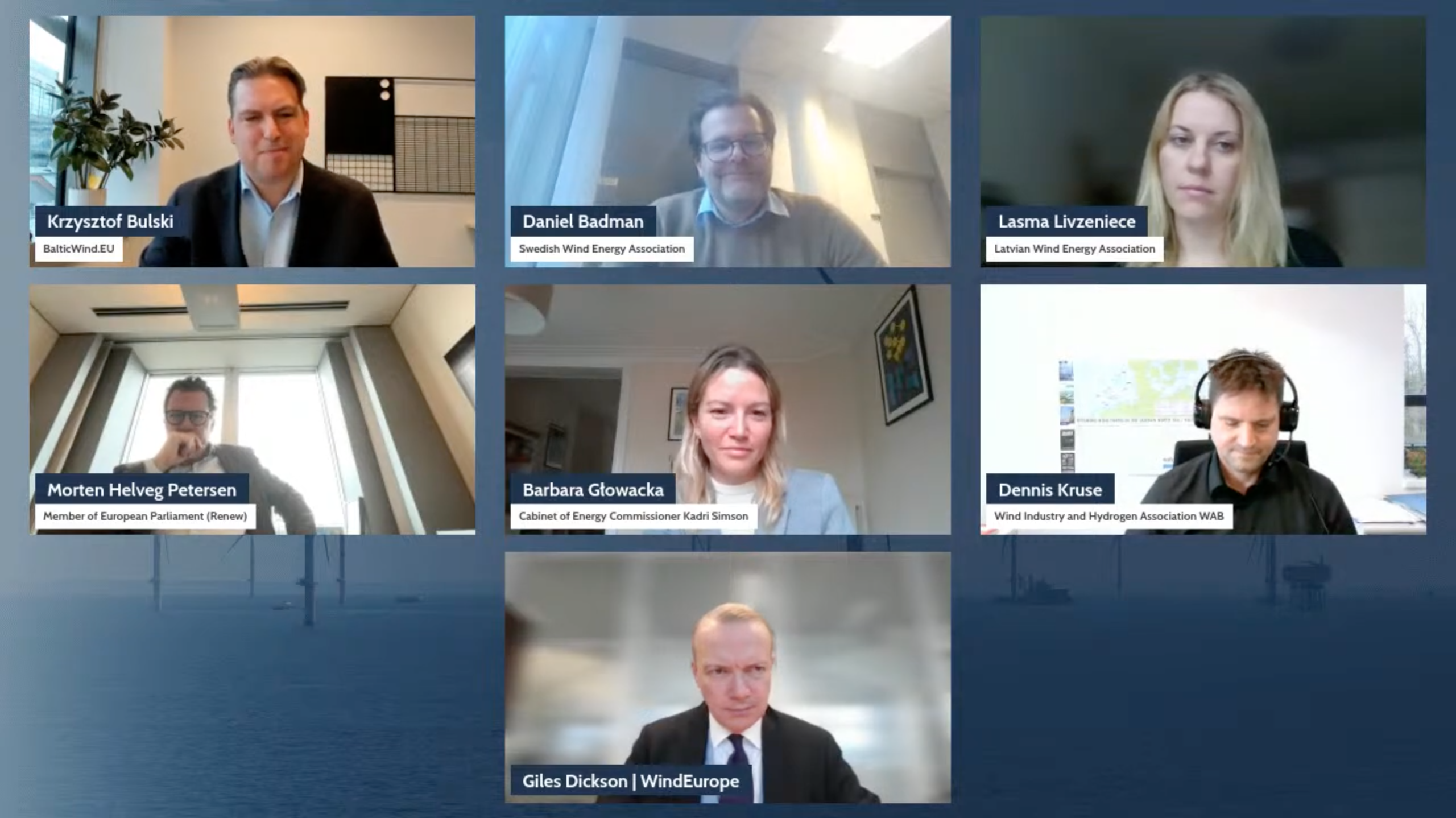

We had the pleasure of speaking to:

- Morten Helveg Petersen, Member of the European Parliament

- Giles Dickson, CEO of WindEurope

- Barbara Glowacka, Member of the Cabinet of EU Commissioner for Energy, Kadri Simson, European Commission

- Lasma Livzeniece, Executive Director at Latvian Wind Energy Association

- Daniel Badman, CEO of The Swedish Wind Energy Association (SWEA)

- Dennis Kruse, Deputy Chairman of the Executive Board of WAB e.V. (Wind Industry and Hydrogen Association WAB e.V.)

3 Takeaways:

Legislative Framework Strengthening: The commitment to significant offshore wind capacity growth in the Baltic Sea by 2030 and 2050 is a remarkable feat. However, achieving these targets necessitates a robust legislative framework. Participants highlighted the importance of directives like the Renewable Energy Directive and the Electricity Market Directive in facilitating renewable energy deployment and offshore wind development. Additionally, the EU’s action plan on grids plays a vital role in ensuring efficient connection of offshore wind farms to the mainland.

Challenges and Opportunities: While there is political and commercial positivity surrounding offshore wind energy, various challenges hinder progress. Issues such as inflation, high interest rates, and supply chain disruptions pose significant obstacles. However, participants emphasized the need for continuous effort and implementation to overcome these challenges and achieve industry goals.

Supply Chain Development and Country-Specific Dynamics: The development of offshore wind projects in the Baltic Sea relies heavily on a robust supply chain. Encouragingly, significant investments are being made in supply chain infrastructure across the region, including the establishment of manufacturing facilities for wind turbine components. However, country-specific dynamics influence the pace of development. While some countries like Poland and Lithuania are making substantial strides, others, like Sweden, face hurdles due to lack of visible government support and urgency. Furthermore, ensuring energy security, particularly in the context of geopolitical challenges and cybersecurity, remains a crucial aspect of offshore wind development in the Baltic Sea.

Barbara Glowacka, Member of the Cabinet of EU Commissioner for Energy, Kadri Simson, reminded that Baltic Sea, we have now a commitment of 22.5GW by 2030 and 46.8GW by 2050. This is really remarkable. But for this to be possible, we have significantly strengthened the legislative framework. “The key is the Renewable Energy Directive and the Electricity Market Directive, which will all help improve the deployment of renewables and offshore wind. In particular, let’s not forget about the EU action plan on grids, which is key to ensuring that we can connect all the farms to the shore. And importantly, we also have the first pipeline of offshore projects that have been included in the list of projects of common interest and projects of mutual interest, including, um, the Bornholm Energy Island and the wind projects in the Baltic Sea.”

Morten Helveg Petersen, Member of the European Parliament, pointed out that the industry faces many challenges in achieving its goals, as demonstrated in 2023. “We all know a lot of the reasons for this in terms of inflation, high interest rates, and supply chain issues. I’d say there’s a lot of positives out there politically, commercially, a lot of opportunity out there, negatives obviously, being lack of speed, lack of implementation, and very serious and critical issues within the industry. So I think that what we need to bring into 2024 is the basic notion that this doesn’t come for free, that we have to keep pushing, we have to ensure implementation of these.”

Giles Dickson, CEO of WindEurope, emphasized the development of offshore projects in the Baltic Sea: “We saw the first-ever final investment decision for offshore wind in Poland last year. Poland should have its first offshore wind farms operating in just a few years’ time. We saw the first auction in Lithuania last year, and they’ve just launched their second auction. Estonia will launch their first auction this year. Latvia wants to do things as well. Denmark will auction three gigawatts of offshore wind around Bornholm this year, and Finland is currently running seabed lease auctions for significant volumes of capacity. So we are quite optimistic.”

Giles Dickson also highlighted that a lot is happening in terms of supply chain development, without which such gigantic investments will not be possible: “On Friday this week, Vestas will lay the foundation stone of a new factory in Szczecin in Poland, to build nacelles and hubs for offshore wind. There’ll be a very big ceremony. The King and Queen of Denmark will be taking part, dignitaries on the Polish side as well. Vestas have just announced they’ll build a second factory next to it, making blades for offshore wind turbines. This is extremely positive. A company has recently announced that in Rostock, they will start building a new factory to make platforms for the transmission converter stations that you need for the grid connections for offshore wind farms. Factories in Finland and Sweden that make the cables for the offshore wind farms are also being expanded, so we’re confident also the supply chain will be able to deliver both for the Baltic and for the rest of Europe.”

The CEO of WindEurope underscored that there is one country in the Baltic Sea basin where offshore development is not as dynamic, and that country is Sweden: “We don’t see any visible signs of support from the public authorities, from the government. They were going to ask the transmission system operator to provide the grid connection. Now they’ve gone back on that. It’s unclear how the grid connections will be built to any offshore wind farms in Sweden. There are some permits being awarded, but there’s very little, if any, active support from the government there for wider political reasons.”

During the discussion, Daniel Badman, CEO of The Swedish Wind Energy Association (SWEA), addressed this issue: “2023 is also the year when the wind industry said that we are ready to invest in Sweden, there are now totally 16 projects waiting for the governmental permit that has 16 projects has applied not only in the Baltic Sea but around the Swedish coast. I fully agree with Giles that we have a little bit of a different situation given that we do not have the auction system and different that we have a bit of a different discussion in Sweden right now. We still lack a little bit of the sense of urgency from the Swedish policymakers right now saying that this needs to be done and it needs to be done fast.”

On the other hand, Lasma Livzeniece, Executive Director at Latvian Wind Energy Association, highlighted another very important aspect of energy security: “The geopolitics have shown that we live next to a very dangerous and aggressive neighbor. And, our critical infrastructure needs to be taken care of, needs to have a very good cooperation when it comes to cybersecurity. So these are extremely, extremely important aspects. And as we are thinking about reinforcing the existing infrastructure and building new one in the Baltic Sea, this will become an even more important topic.”

During the Baltic Sea Offshore Wind 2024 Outlook, attendees also learned about the development of the sector in Germany this year and the challenges it faces.

Dennis Kruse, Deputy Chairman of the Executive Board of Wind Industry and Hydrogen Association WAB e.V., said: “In the Baltic Eagle project from Iberdrola, we will see the installation; the foundations were already installed, and the complete installation will be ended within this year. In this project, we will see 50 wind turbines from Vestas with all together 476 megawatts. So regarding the challenges, we already talked about the ambitions, ambitious goals. You might know that in Germany, we want to reach 30 gigawatts in 2030 and 70 gigawatts in 2045, and we will really have challenging times in front of us to install more than six gigawatts in 2029 and more than nine gigawatts in 2030.”

Overall, the discussions at the Baltic Sea Offshore Wind 2024 Outlook underscored both the progress made and the hurdles yet to be overcome in advancing offshore wind energy in the region.

Source: BalticWind.EU