This morning, Ørsted announced the approval of the new strategic ambition and financial guidance by the company’s Board of Directors. The announcement was made during the company’s Capital Markets Day event. One of the highlights of the event is the offshore presentation held by Martin Neubert, CCO & Deputy Group CEO of Ørsted.

Over the past decade, Ørsted has built a global market-leading position in renewable energy with a total of 12 GW of installed renewable capacity. Looking ahead, the global build-out of renewable energy is expected to accelerate significantly, supported by governments around the world committing to ever more ambitious renewable-specific targets to limit global warming. By 2030, the global installed capacity of renewable energy is expected to almost triple. Offshore wind is expected to grow by a factor of 7 and onshore renewables by a factor of 2.5-3. This massive build-out of renewable energy presents unparalleled growth opportunities for Ørsted.

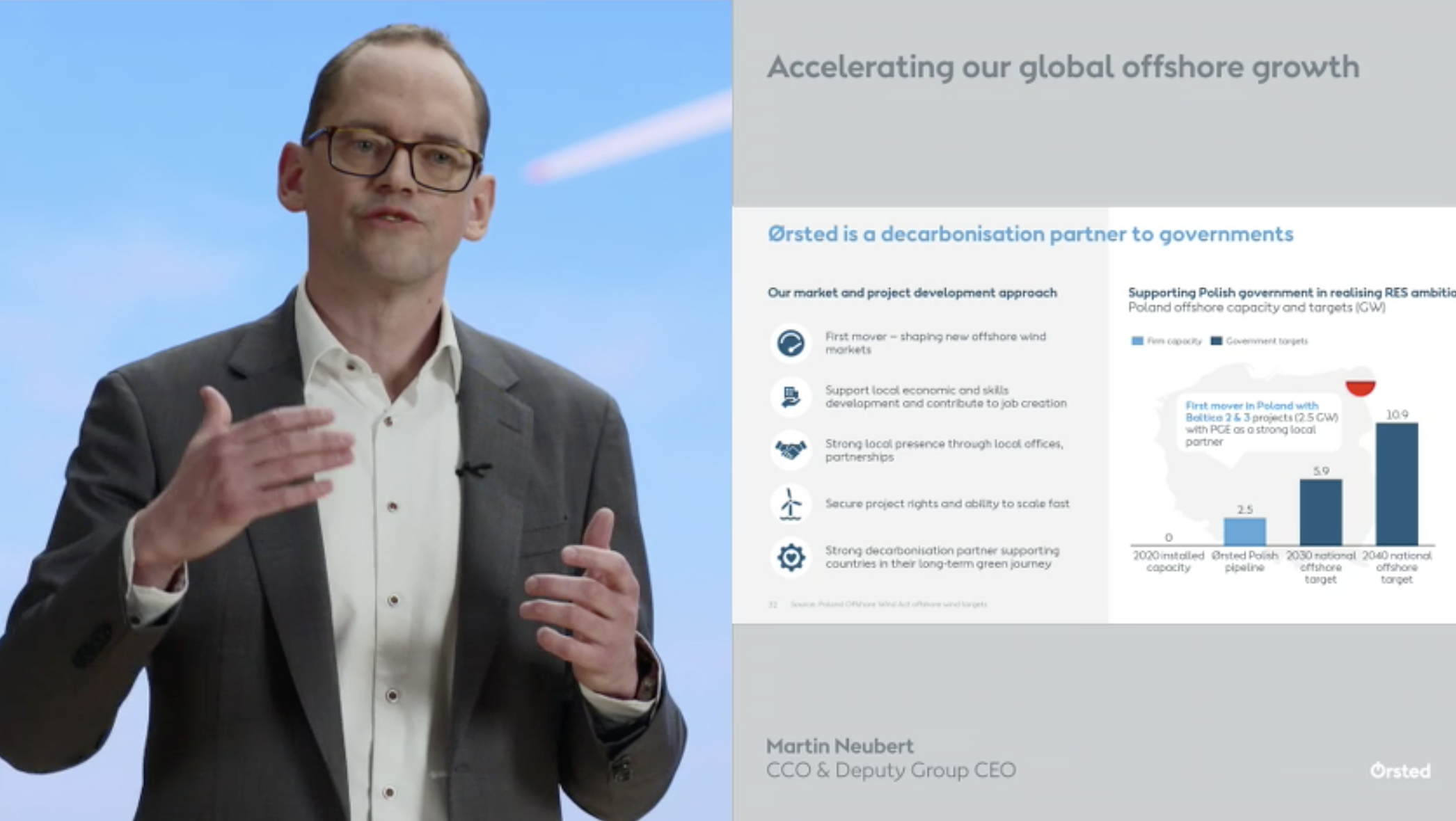

Ørsted now accelerates its global build-out of renewable energy and sets the ambition to reach approx. 50 GW of installed capacity by 2030. To support this ambitious build-out, Ørsted plans to invest approx. DKK 350 billion in green energy from 2020 to 2027, accelerating average yearly investments by approx. 50 % since the last Capital Markets Day.

“Our aspiration is to become the world’s leading green energy major by 2030. With the offshore wind industry’s largest concrete development pipeline, our global development organisation, and our industry-leading commitment to innovation, it’s our clear aspiration to remain the global market leader in offshore wind.” – said Mads Nipper, Group President and CEO of Ørsted

Ørsted’s strategic ambition for build-out of renewable energy is raised from +30 GW announced at the Capital Markets Day in 2018 to approx. 50 GW by 2030, of which approx. 30 GW will come from offshore wind, approx. 17.5 GW from onshore wind and solar PV, and approx. 2.5 GW from other renewables, including sustainable biomass, renewable hydrogen, and green fuels. This ambition corresponds to an investment level for the period 2020-2027 of approx. DKK 350 billion of which approx. 80 % is expected to be within offshore wind, including renewable hydrogen, and approx. 20 % within onshore.

In the period 2020-2027, Ørsted expects a growth in operating profit (EBITDA) from offshore and onshore assets in operation of approx. 12 % a year on average, reaching a level of DKK 35-40 billion in 2027. The growth rate assumes that all offshore projects where Ørsted does not already have a joint venture partner are farmed down to a 50 % ownership stake.

Ørsted has high visibility on future earnings with approx. 90 % on average of Ørsted’s operating profit (EBITDA) for the period 2020-2027 coming from regulated or contract-based activities.

“Furthermore, we are today, with immediate effect, announcing a ban on the landfilling of wind turbine blades. Going forward, Ørsted commits to either reusing, recycling, or recovering 100 % of all blades coming from repowering or end-of-design-life decommissioning of our onshore and offshore wind farms. It’s our aspiration to be a leading catalyst for the global green energy transition towards a world that runs entirely on green energy and to be the preferred partner for our customers, local communities, suppliers, and joint venture partners, enabling all our stakeholders to realise the green transformation and its benefits.” – added Mads Nipper, Group President and CEO of Ørsted.

Going forward, Ørsted’s targeted range for the fully loaded unlevered lifecycle spread to weighted average cost of capital (WACC), at the time of bid/final investment decision (FID) whichever comes first, for our offshore and onshore projects will be 150-300 basis points, which is consistent with the implied value creation spread from our last guided return. The targeted rate is not a hurdle rate and, consequently, there could be projects that deviate from the targeted range.

The average return on capital employed (ROCE) for 2020-2027 is expected to be 11-12 %.

Source: Ørsted