The global offshore wind industry is in turmoil with high-profile projects being paused in key markets. How European governments handle award of 50GW planned leases in 2024-25 could radically change sector dynamics at home and abroad, writes Victoria Maguire Toft. This insightful analysis was first introduced in the Aegir Insights newsletter Beaufort. For a deeper dive into the topic, you can access the original article here

After a decade of fast-paced progress in the global offshore wind industry, 2023 has been a time of upheaval and uncertainty that has left a number of gigascale projects in the US and UK either cancelled or paused due to rapidly evolving market landscape.

For Europe, the next two years will be critical to its ambitions to have 300GW of sea-based wind plant operating by mid-century. The region has an unprecedentedly large pipeline of auctions coming through to 2030, which could transform the dynamics of the sector by creating conditions in which governments need to attract developers more than developers need to win over governments.

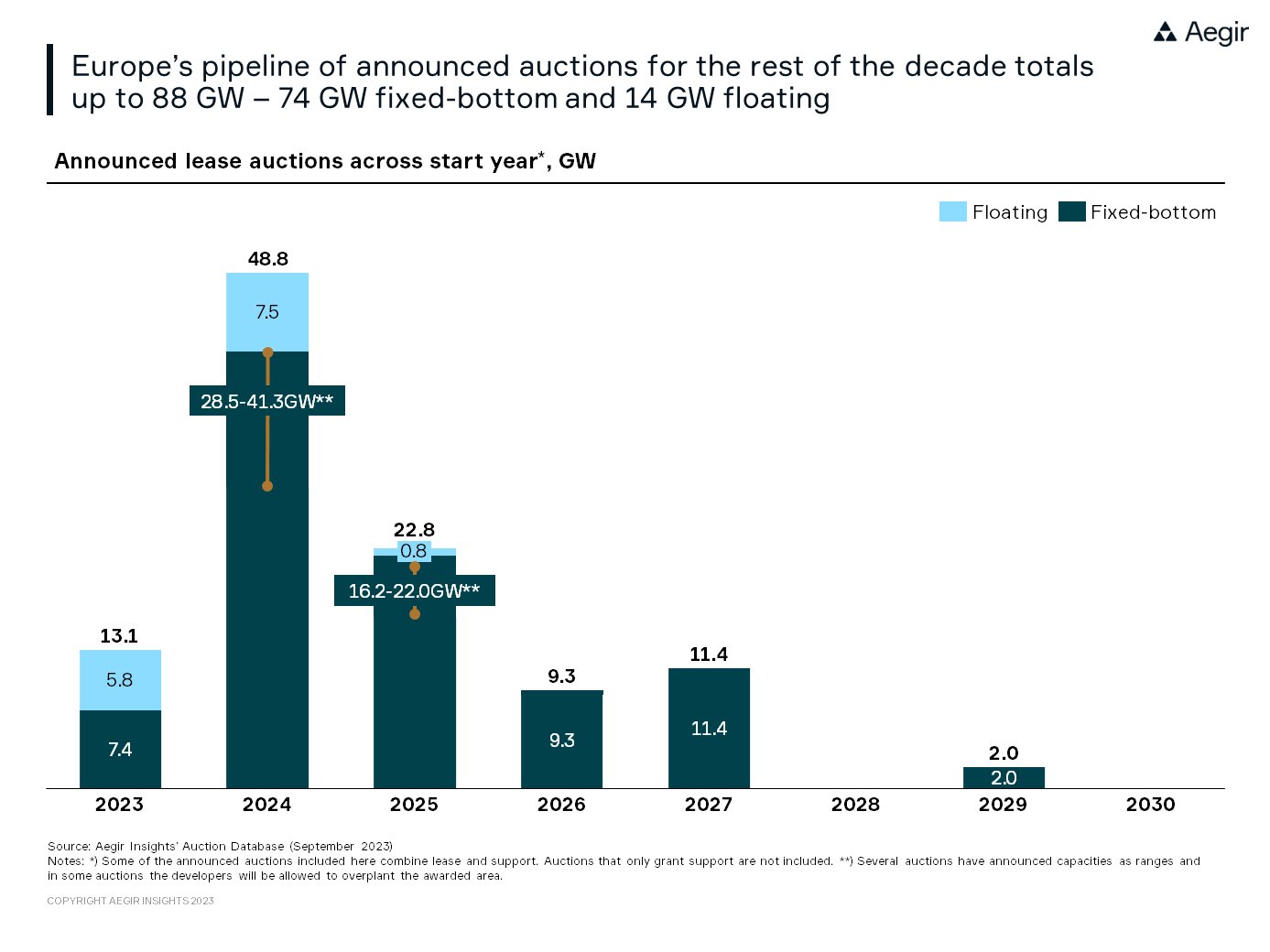

Auctions currently planned across 14 European markets could lead to the award of leases totaling up to 88GW by 2029, the majority of which, 74GW, will suit conventional fixed-bottom projects, while the remaining 14GW will call for floating technology.

Next year and 2025 will be the busiest for auctions, with 2024 alone having the potential to see almost 50GW awarded.

But as site attractiveness, regulatory frameworks and subsidy options vary across the markets, the next two years could be key to determining where developers choose to focus their resources and capital.

As developers are struggling to secure viable business cases due to cost increases and squeezed supply chain, auctions including subsidies – in markets such as Ireland and France – could have a competitive advantage over pure lease auctions.

The peril for many European nations is that without successful completion of the planned auctions in the next couple of years, they will be at risk of not meeting their 2030 offshore wind goals. And it will be especially interesting to keep an eye on upcoming auctions in Germany and Denmark, both recently have moved away from old auction models to launch leasings without subsidies.

Source: Aegir Insights