The latest annual statistics and seven-year outlook published by WindEurope reveal significant advancements in the European wind energy sector, particularly in the offshore market and among countries bordering the Baltic Sea. The report indicates that the European Union is on track to achieve its wind energy targets for 2030, owing to improvements in permitting processes and a resurgence in investments. However, challenges persist, with the timely expansion of both onshore and offshore electricity grids emerging as a critical concern.

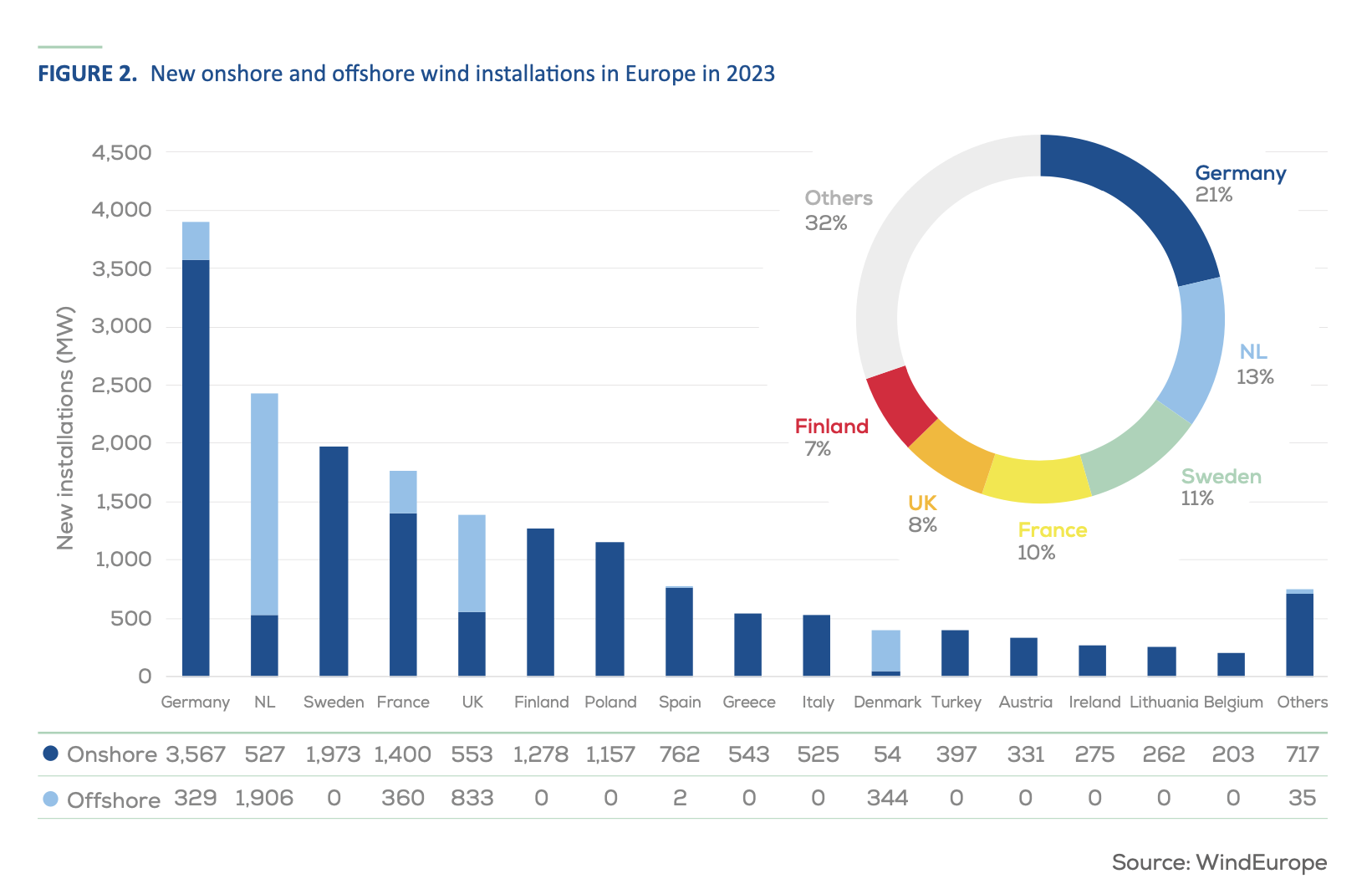

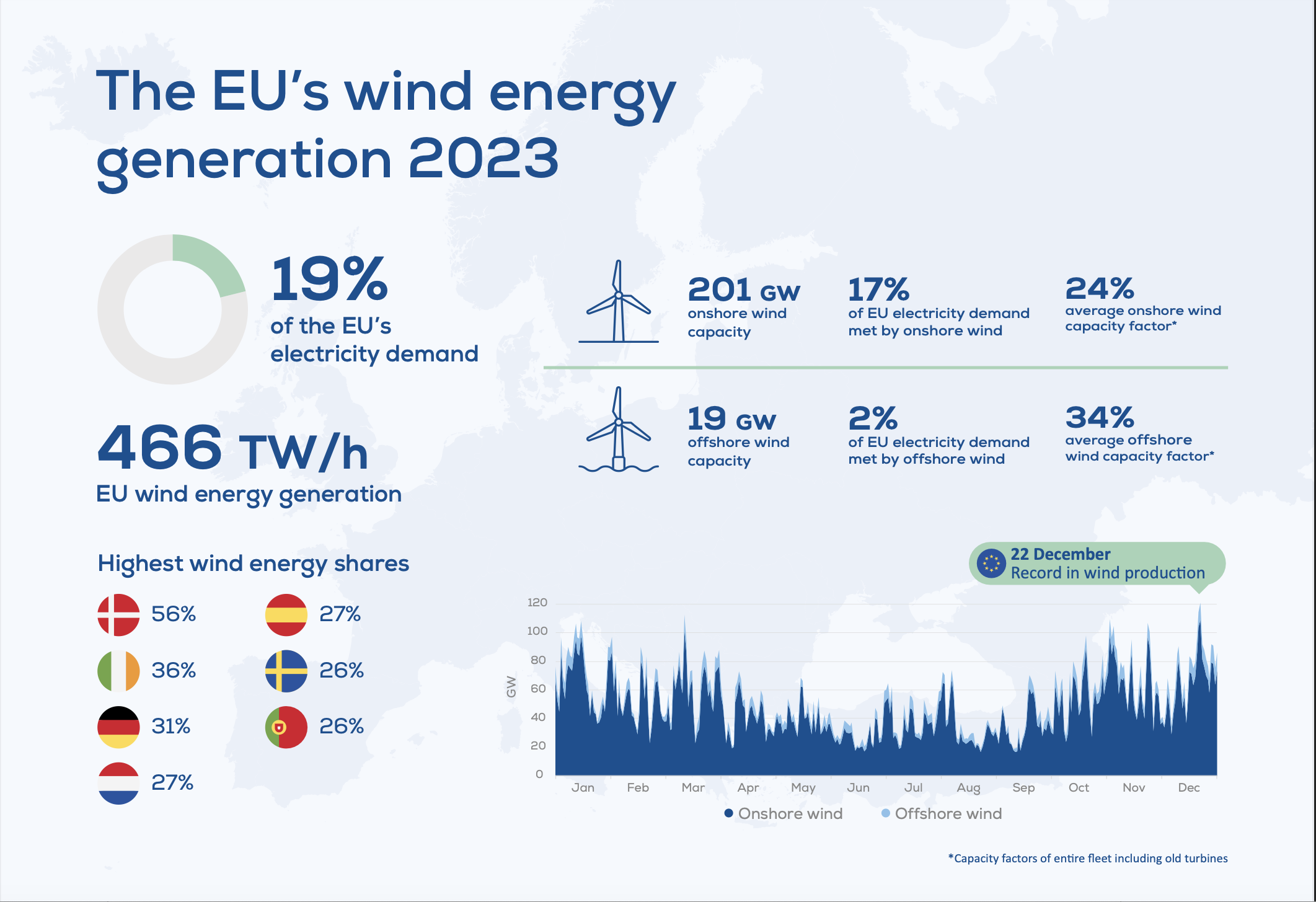

In 2023, the European Union witnessed a remarkable surge in wind energy capacity installations, reaching a record 16.2 GW. Notably, 79% of this capacity came from onshore wind projects, showcasing the continued dominance of land-based installations. Additionally, over 1 GW of capacity was added through the repowering of aging turbines, indicating a strategic focus on modernization within the sector.

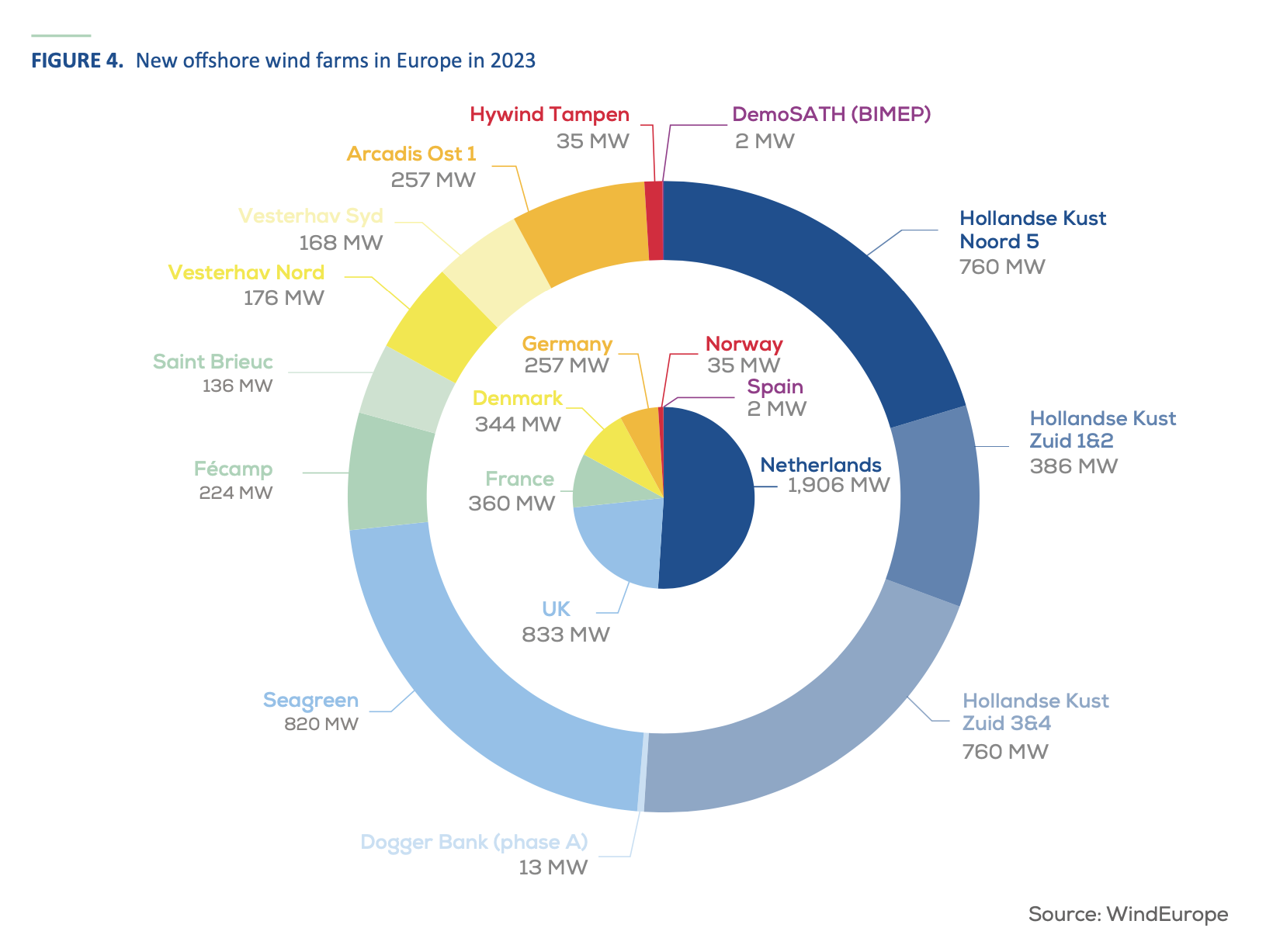

Offshore wind installations also experienced unprecedented growth, with Europe adding a record 3.8 GW of new capacity. Within the EU-27, installations reached 2.9 GW, setting another record for the region. This surge was supported by a significant increase in “Final Investment Decisions” (FIDs), which more than doubled compared to the previous year. Investments in new offshore wind farms soared to €30 billion, marking a substantial rebound from the minimal investments observed in 2022.

Governments across Europe played a pivotal role in driving growth, as evidenced by the allocation of 26 GW of new capacity through wind energy auctions in 2023. Half of this capacity was dedicated to offshore projects, reflecting a growing emphasis on expanding marine wind farms. Overall, Europe’s installed wind power capacity now stands at 272 GW, with 238 GW from onshore installations and 34 GW from offshore projects. Notably, offshore wind accounted for 21% of total installations in Europe, with 3.8 GW of capacity connected to the grid.

The Baltic Sea region emerged as a focal point for offshore wind development, with notable installations in Germany and Denmark. Germany connected 257 MW of offshore wind capacity in the Baltic Sea, primarily from the Arcadis Ost 1 wind farm. Furthermore, Denmark commissioned the Vesterhav Nord and Vesterhav Syd projects, adding 344 MW of new offshore wind capacity to its portfolio.

In addition to the remarkable growth in offshore wind installations, the European wind energy sector saw significant activity in auctions and tenders, further accelerating the expansion of offshore wind capacity. Germany, a key player in the European wind market, made headlines by awarding 8.8 GW of offshore wind capacity through a groundbreaking zero-subsidy tender.

This innovative tender featured a unique “dynamic bidding” system, where if two or more bids at €0/MWh were received, the bidders entered a second round to determine their willingness to pay per MW installed. Ultimately, winning bidders committed to a staggering payment of €12.4 billion, signaling a strong investor confidence in the future of offshore wind in Germany.

The awarded capacity was distributed across four sites, with three located in the North Sea and one in the Baltic Sea. Notably, 7 GW of the capacity were centrally pre-surveyed, ensuring optimal site selection and project viability. The remaining 1.8 GW were awarded across four sites in the North Sea that were not centrally pre-surveyed, demonstrating Germany’s commitment to both innovative and traditional approaches to offshore wind development.

Looking ahead to 2024, Germany plans to auction an additional 5.5 GW of centrally pre-surveyed capacity and 2.5 GW of non-centrally pre-surveyed capacity, further solidifying its position as a frontrunner in offshore wind deployment.

Meanwhile, Lithuania made significant strides in its offshore wind ambitions by holding its first auction for offshore wind energy. Using a negative bidding system, the country awarded 700 MW of capacity for a development fee of €20 million. This auction marked a pivotal moment for Lithuania’s renewable energy transition and laid the groundwork for future offshore wind projects.

Building on this momentum, Lithuania is set to hold a second offshore wind auction in 2024. However, in a strategic shift, the negative bidding mechanism will be replaced by a 2-sided Contract for Difference, introducing bidding floors and ceilings to ensure fair and competitive pricing. With these measures in place, Lithuania aims to attract further investment and drive the rapid expansion of its offshore wind sector.

Grids are the new main bottleneck

To increase annual wind installations from 16 GW in the EU last year to an average 29 GW pa up to 2030 Europe needs to urgently accelerate the build-out of new and optimised electricity grids. Grid connection queues are delaying the timely connection of new wind farms. Hundreds of GWs of new wind farms are currently waiting for their grid connection.

Delays in the build out of onshore and offshore grid connections put the timely commissioning of new wind farms at risk. In Germany authorities recently announced that up to 6 GW of offshore wind capacity are affected by grid connection delays. The affected wind farms will now come online with a delay of up to two years.

Source: WindEurope

Looking ahead, the momentum in the European wind energy sector is expected to continue, driven by supportive government policies, technological advancements, and growing investor confidence. However, addressing grid expansion challenges will be crucial to sustaining this growth trajectory and ensuring the efficient integration of renewable energy sources into the broader energy landscape. As Europe strives to achieve its ambitious climate targets, the wind energy sector is poised to play a central role in driving the transition towards a more sustainable and resilient energy future.

Source: WindEurope