As of June 30, 2025, 1,639 offshore wind turbines with a total capacity of 9.2 gigawatts (GW) were connected to the grid in Germany. An additional 1.9 GW of capacity is under construction. Final investment decisions have been made for projects totaling 3.6 GW. Further projects with a combined capacity of 17.5 GW have been awarded but not yet commissioned. These figures were determined by the consulting firm Deutsche WindGuard on behalf of the industry associations and organizations of the German offshore wind industry.

The German government is responsible for setting the necessary energy and industrial policy course to ensure that as many projects as possible are realized in the future. “Offshore wind energy plays a central role in the success of the energy transition. The industry must be able to rely on maintaining the expansion target of 70 GW by 2045.

The fact that this was reaffirmed in the coalition agreement is an important signal,” emphasize the industry organizations BWE, BWO, VDMA Power Systems, WAB e.V., WindEnergy Network e.V., and the non-profit OFFSHORE-WINDENERGIE Foundation.

For a cost-optimized and supply-security-oriented expansion of offshore wind energy, the following measures must be implemented promptly and decisively:

- A future revenue model must better ensure project realization and investment security – for instance, when considering Contracts for Difference (CfDs) mechanisms. It is important that the market framework is harmonized across Europe as much as possible and that potential Power Purchase Agreements (PPAs) are not curtailed.

- Adjustment of the statutory realization deadline by which operators must demonstrate the technical operational readiness of their offshore wind turbines – from currently six to at least twelve months after completion of the grid connection, to reflect planning realities in GW projects and reduce connection costs.

The industry associations and organizations positively assess that further key prerequisites for future offshore wind expansion are already enshrined in the coalition agreement.

For example, shading effects are to be explicitly reduced, and shared maritime area potentials are to be efficiently exploited in cooperation with neighboring countries to increase full-load hours and minimize system costs. The Coordinator of the Federal Government for Maritime Economy and Tourism, Dr. Christoph Ploß, also assured that the federal government will assume greater responsibility for financing port infrastructure.

Flexibility in Oversizing

For the first time, the offshore wind area N-9.4, auctioned in June 2025 with a grid connection capacity of one gigawatt, will have a mandatory oversizing of 10 to 20 percent. The goal is to achieve higher utilization of the offshore grid connection system. However, from the organizations’ perspective, this requires a more flexible planning approach that is more balanced between wind farm developers and grid operators. The so-called “sweet spot” of the optimal oversizing degree varies depending on the location and should be the responsibility of the project developers.

Urgent Reform of the Wind Energy at Sea Act and Auction Design

The most recent auction of an offshore wind area in June 2025 was awarded for only 180 million Euros – substantially less than in previous auction rounds. This is a clear sign that offshore wind developers are facing an unhealthy level of risk. This includes not only rigid oversizing requirements but also supply chain bottlenecks.

The industry associations and organizations sharply criticize the fact that the June auction was conducted for the third consecutive year under the same rules – even though this pure willingness-to-pay query is rejected by a broad alliance of national and European stakeholders, including the EU Commission. The decreasing number of bidders to a minimum of two, and correspondingly declining bids, as well as the persistently high pressure on the supply chain, demonstrate the urgent need for reform. A fundamental revision of the auction design this year is unavoidable.

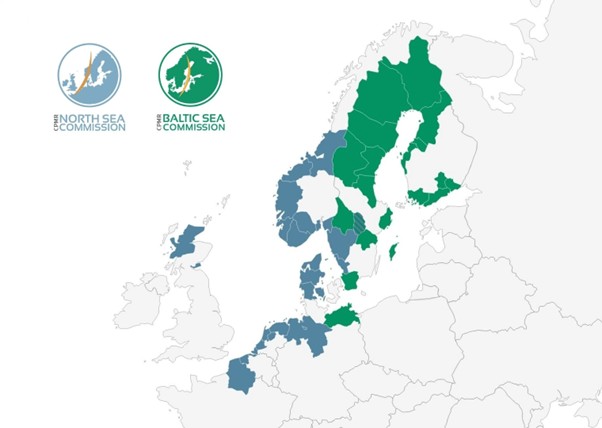

In addition to the homework in Germany, two points, in particular, must be implemented at the European level: First, there is a need for harmonization of the auction framework, for example, through the unbureaucratic implementation of the Net Zero Industry Act in as many European offshore wind energy markets as possible. Second, a competitive and fair level playing field must be created, and industrial policy support for European manufacturers and suppliers is also essential.

Securing Offshore Infrastructure – Thinking Integrally

Offshore wind energy is also an elementary part of critical infrastructure. It must be ensured that security-relevant vulnerabilities, especially in the area of cybersecurity, are avoided along the entire supply chain. For this, the EU NIS2 Directive must be implemented efficiently and swiftly. The same applies to the implementation of the European CER Directive for the physical protection of critical infrastructure.

The German government must design the framework for integrated security in such a way that contributions from the economy are legally secure and predictable – with a clear respect for the limits of civilian responsibility.

Source: BWO