The International Renewable Energy Agency (IRENA) has just released its pivotal “Renewable Power Generation Costs in 2024” report, delivering a resounding message: renewables are unequivocally the most cost-competitive option for new electricity generation globally. This comprehensive analysis, compiled from IRENA’s extensive renewable cost database of over 25,000 projects, highlights how 91% of newly commissioned utility-scale renewable capacity in 2024 delivered power at a lower cost than the cheapest new fossil fuel-fired alternative. This reinforces their crucial role in energy security, economic stability, and resilience in a volatile global energy landscape, saving an estimated USD 467 billion in fossil fuel costs in 2024 alone.

While the global figures paint an optimistic picture, let’s delve into the specifics for our region, focusing on onshore and offshore wind energy in Europe, especially around the Baltic Sea.

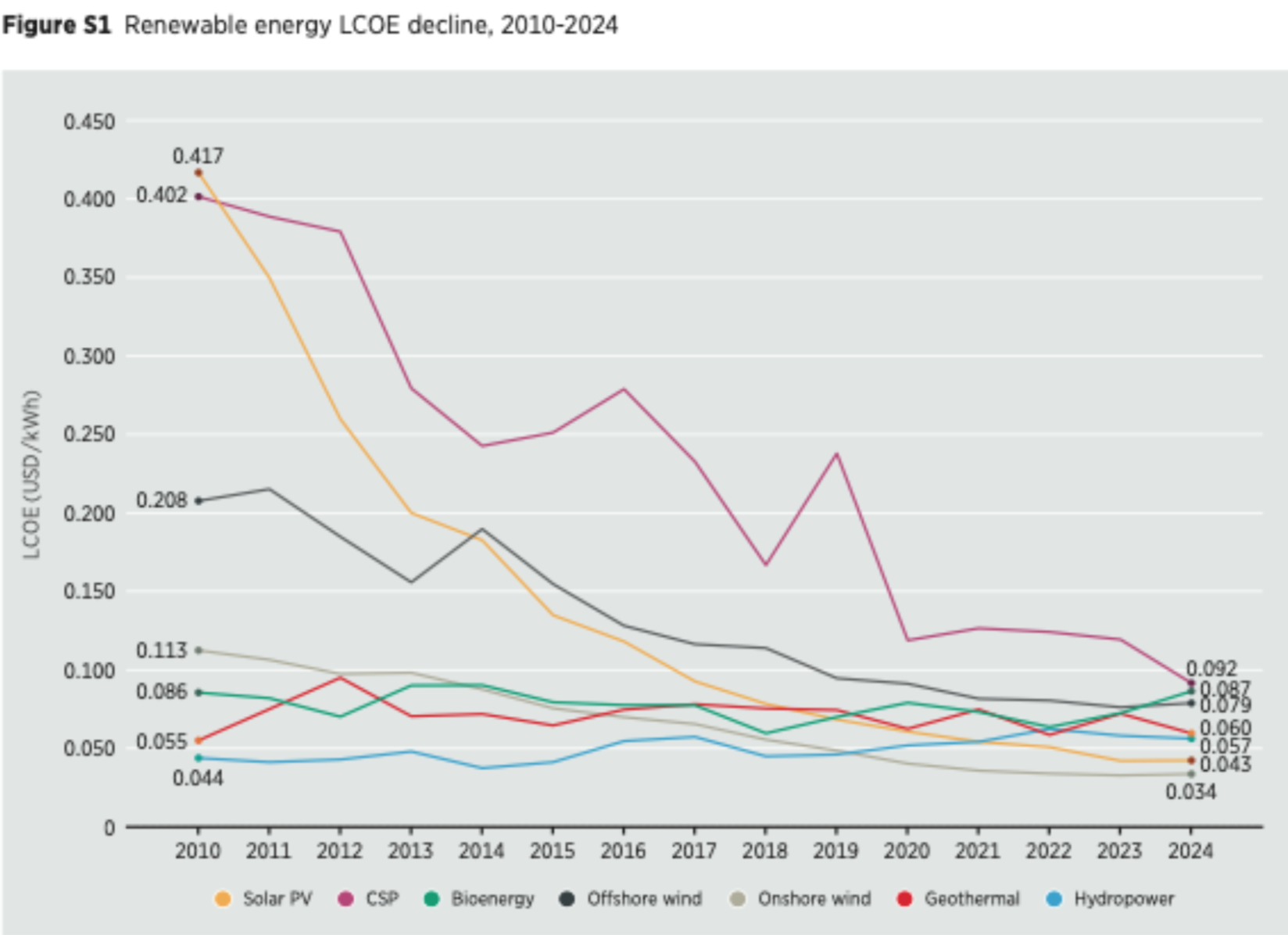

This chart vividly illustrates the impressive cost reductions across various renewable energy technologies over the past decade, placing wind and solar at the forefront of affordability.

Onshore Wind: Stability Amidst Growth

Onshore wind has consistently proven its affordability, retaining its position as the most affordable source of new power generation globally with a weighted average Levelised Cost of Electricity (LCOE) of USD 0.034/kWh in 2024. Since 2010, the global weighted average LCOE for onshore wind has plummeted by 70%.

However, the report notes a slight global uptick of 3% in LCOE for onshore wind in 2024, a trend influenced by financing costs and varying capacity factors in key markets. Despite this, total installed costs (TIC) continued their sharp decline, falling 55% between 2010 and 2024 to USD 1,041/kW globally.

For Europe, the onshore wind LCOE in 2024 averaged USD 0.051/kWh. Notably, the report highlights a significant difference in cost structure compared to regions like Africa: in Europe, LCOE is primarily driven by capital expenditure (CAPEX), whereas in many African countries, financing costs account for the majority share. This underscores the importance of reducing the cost of capital, especially in emerging markets, to further lower LCOEs.

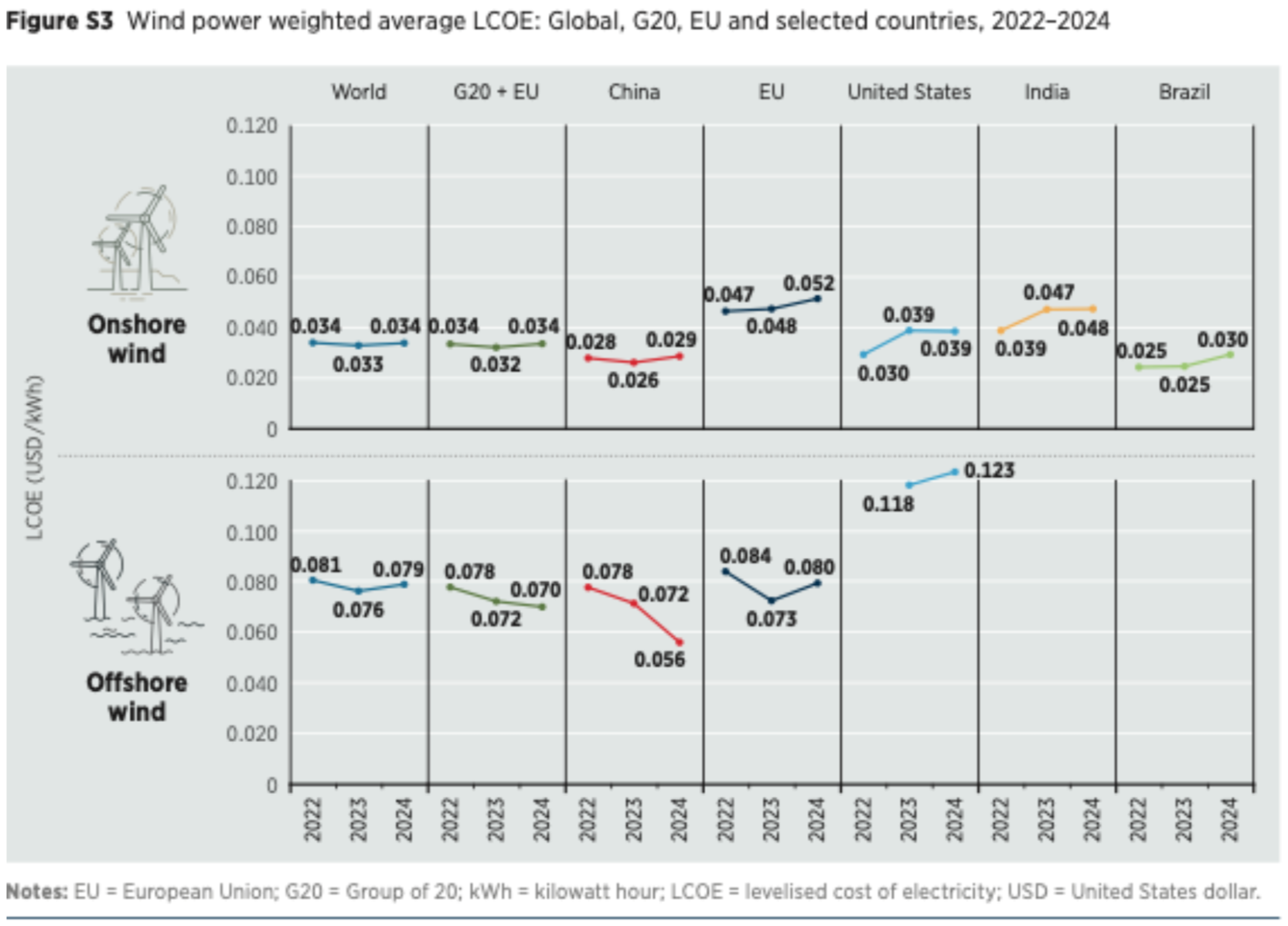

This provides a direct comparison of onshore and offshore wind LCOEs, highlighting regional differences and the competitive edge of certain markets relevant to Europe.

Looking at specific countries relevant to the Baltic Sea:

- Germany saw an onshore wind LCOE of USD 0.047/kWh in 2024.

- Poland registered an LCOE of USD 0.040/kWh.

- Sweden had an LCOE of USD 0.039/kWh.

- Finland recorded an LCOE of USD 0.042/kWh.

- Denmark had O&M costs for onshore wind at USD 40/kW/year.

Technological advancements, such as larger turbines and higher hub heights, have contributed to an improved global weighted average capacity factor, rising from 27% in 2010 to 34% in 2024. However, challenges like grid constraints and permitting delays continue to impact development, particularly in Europe and North America.

Offshore Wind: Costs and Capabilities in Focus

Offshore wind also showcases significant long-term progress, with its global weighted average LCOE falling by 62% between 2010 and 2024, reaching USD 0.079/kWh. However, similar to onshore wind, 2024 saw a slight increase of 4% year-on-year, after a record low in 2023. This increase is attributed to shifts in market share and the growing presence of projects in emerging markets facing higher initial costs.

Total installed costs for offshore wind globally reached USD 2,852/kW in 2024, a 48% reduction since 2010. The global cumulative installed capacity for offshore wind soared from 3.1 GW in 2010 to 82.9 GW in 2024, a more than twenty-five-fold increase.

For Europe, the weighted average LCOE of newly commissioned offshore wind projects increased by 23% from USD 0.065/kWh in 2023 to USD 0.080/kWh in 2024. This was accompanied by a 12% year-on-year increase in total installed costs, while the capacity factor for new projects slightly decreased from 49% to 48%.

Key European insights from the report include:

- Denmark stands out with the lowest weighted average offshore wind LCOE in Europe at USD 0.053/kWh in 2024. Denmark also reported a capacity factor of 52% in 2024.

- Germany‘s offshore LCOE averaged USD 0.069/kWh in 2024, with its TIC decreasing by 61% between 2010 and 2024, reaching USD 3,000/kW. Germany also commissioned a significant 742 MW offshore wind capacity from a single project in 2024.

- The Netherlands reported an offshore LCOE of USD 0.066/kWh in 2024.

- The United Kingdom, while not a Baltic Sea country, is a significant European player, achieving an offshore LCOE of USD 0.059/kWh in 2024 and a 44% increase in capacity factor since 2010, reaching 52%.

European projects are increasingly located in deeper waters (18m to 57m) and further from shore (65km to 130km), with monopile foundations dominating (78% of installed capacity). Europe led global auction activity in 2024, offering support for at least 23.3 GW of offshore wind. Floating offshore wind is also gaining momentum, with early large-scale deployments expected in the early 2030s.

The Path Forward

The IRENA report underscores that while long-term cost reductions are expected due to continued technological learning and supply chain maturity, emerging geopolitical risks and Chinese manufacturing dynamics could lead to short-term cost increases. Financing costs remain a critical barrier, particularly in markets with elevated risk premiums, influencing the overall project viability.

Despite these challenges, the trajectory of renewable energy is clear. The global energy transition requires not just rapid deployment but also substantial investment in enabling infrastructure, especially grid expansion and energy storage.

Source: IRENA