Nordic grid operators Fingrid, Energinet, Statnett and Svenska kraftnät have published the Nordic Grid Development Perspective (NGDP) 2021 report. The study presents a path to a climate-neutral Nordic energy system. The “Climate Neutral Nordics” scenario foresees a doubling of RES capacity by 2040.

The NGDP report presents a common Nordic “Climate Neutral Nordics” scenario that assumes high growth in electricity consumption in the Nordic countries. The NGDP report also included an analysis of future high level system needs based on the scenario created. According to the results, the transmission needs in the future system are increasing and there is a great need to grow the network capacity. In addition, existing flow patterns may change significantly in the future.

Moreover, the report presents three thematic area analyses: north-south capacity transfer, resource adequacy, and offshore wind development. The report also provides an update on the Nordic corridors, of interest to NGDP2019.

Climate neutrality needs more energy – investment in grid and cross-border connections is needed

Electricity consumption will increase in the Nordic countries from the current 400 TWh to about 660 TWh by 2040. At the same time, this scenario assumes a more than doubling of renewable energy generation capacity – from 85 GW to about 190 GW by 2040. Existing patterns of energy flow can change significantly. There is a need to reinforce the networks in the Nordic countries and major investments are needed to increase network capacity in several Nordic corridors.

The Nordic countries are an excellent location for future investments, especially energy-intensive ones

Scandinavian transmission system operators are making significant investments in the electricity grid to be able to combine the electricity production and consumption required in a neutral climate. A lot of competitively priced and environmentally friendly electricity will be available in the Nordic countries, so the potential for energy-intensive projects will increase.

The system will be variable – flexibility is key

With increasing variability in power systems, the demand for flexibility across the power system is increasing. In addition, energy transition and electrification are increasing the demand for flexibility services that help optimize the development and operation of the future system. Flexibility resources such as demand side response (DSR), power-to-X (P2X), storage, and electric vehicles will become increasingly important to offset fluctuations in the Nordic system. However, conventional sources, especially reservoir hydropower, will remain an important resource in the future system.

The system is more complex – new technologies like offshore wind and power-to-X will emerge

New solutions and cooperation across the energy system are needed. The future system is becoming more complex, with different sectors of the economy increasingly interlinked. The future system will include large amounts of new resources and technologies, such as offshore wind and P2X.

The EU Commission is aiming for around 60 GW of offshore wind capacity in 2030 and 300 GW in 2050 in Europe. A large part of these new wind farms will be connected to the Nordic countries, in the Baltic Sea and the North Sea. The number and size of planned offshore wind farms in the Nordic countries is growing rapidly. In addition to the construction of radial lines, the massive deployment of offshore wind farms may require new offshore grids to connect offshore wind farms located far from shore to nodes that can be connected to multiple countries (e.g. energy islands). Such offshore grids are not technically mature enough, but are necessary for the integration of offshore wind in multiple markets.

The Nordic transmission system operators expect a significant increase in connected offshore wind power over the next 20 years. Currently, the total connected offshore wind capacity is about 2.5 GW. The Nordics scenario assumes a capacity increase to 17 GW in 2030 and 35 GW in 2040.

Regional plans and network studies will be updated regularly

Operators report that the NGDP document will be updated every two years and is just one of many different regional network development initiatives. The next NGDP report is due in 2023. The Nordic TSOs are also preparing a joint Nordic strategy, which will be published in the Solutions report in 2022. In addition to the system planning aspects, the strategy will provide a broader view covering markets and system operations. Furthermore, the Nordic TSOs have identified the need to develop medium-term cooperation on both operational and planning aspects to complement long-term cooperation.

In the European context, ENTSO-E is currently publishing a European Ten-Year Network Development Plan (TYNDP). The Baltic Sea Regional Investment Plan is published as part of the TYNDP. Moreover, each TSO shall constantly update its national network development plans and publish long-term market and network analyses. These reports focus more on national aspects.

It is also important that Nordic planning and cooperation processes are transparent and that stakeholders are involved at an early stage. Stakeholder engagement through workshops and consultations will therefore continue to be an important part of the planning of the Nordic Network and other forms of collaborative cooperation.

Operators’ investments in 2021

The Nordic TSOs are currently implementing significant investments to increase the future capacity of the grid over the next 10 years. The individual operators will make the following investments (investment value estimated in 2021):

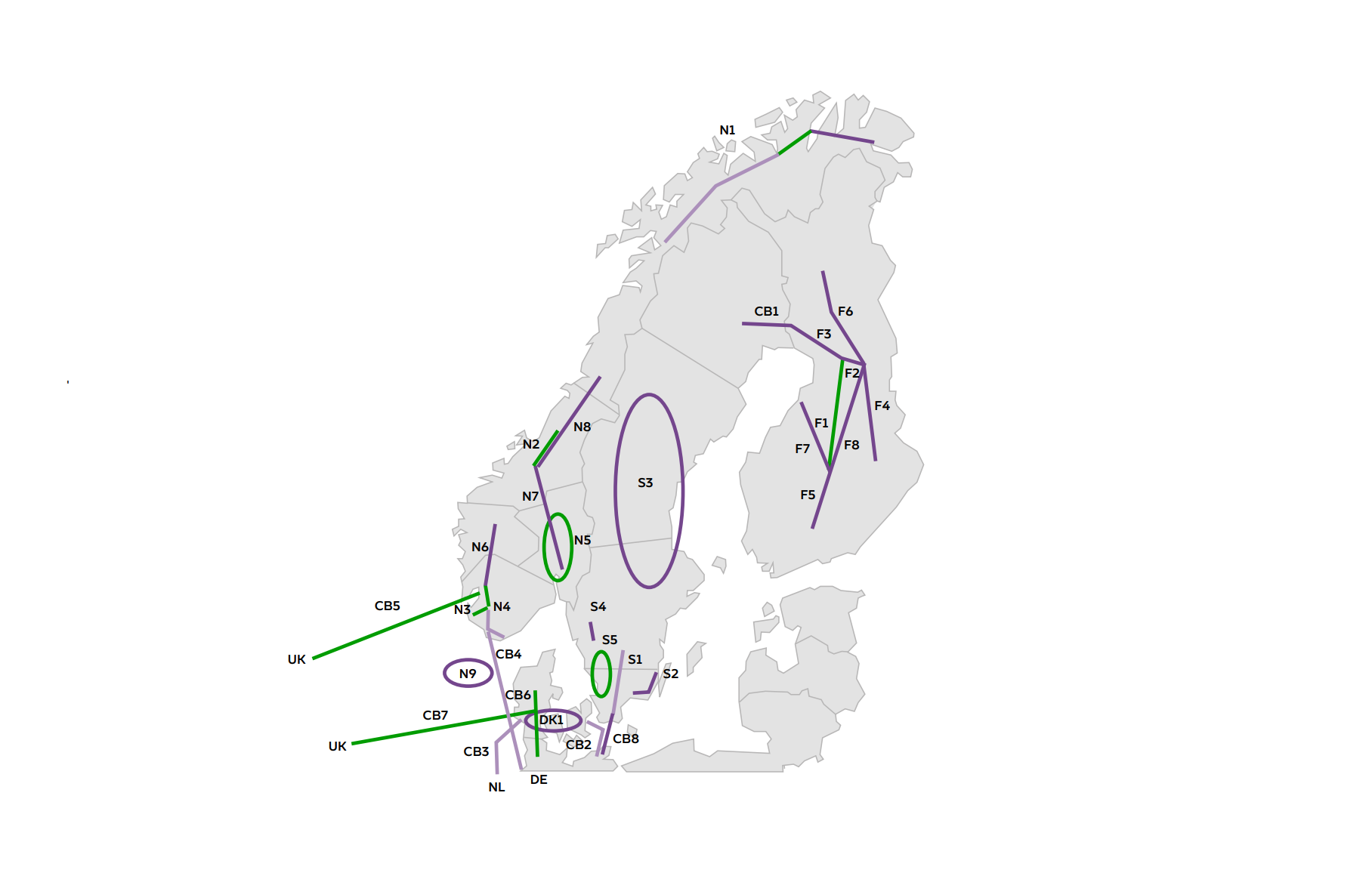

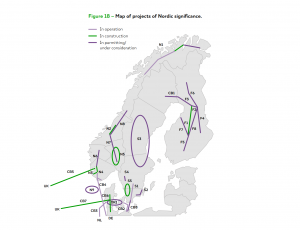

Source: Map – NORDIC GRID DEVELOPMENT PERSPECTIVE 2021

- Energinet is building about 3000 km of cables/lines, 8 new substations and will make total investments of approx. 7.8 billion (does not include Energy Islands)

- Fingrid builds 3700 km of lines, 41 new substations and implements investments with a total value of about EUR 2.1 billion

- Statnett is building 2,500-4,000 km of lines, 30-35 new substations and making investments totaling approx. 6-10 billion euro

- Svenska kraftnät is building 800 km of lines, 20-30 new substations and will make investments with a total value of about 8.1 billion euros

Nordic TSOs will collectively build more than 10,000 km of lines, more than 100 new substations, and make investments with a total value of around €25 billion (at 2021 adopted value).