The EU Clean Industrial Deal aims to boost electrification and renewables deployment as a driver for industrial competitiveness. But the new WindEurope and VaasaETT report “Revamping electricity bills for a competitive and secure Europe” shows that high taxes and levies on electricity undermine the business case for electrification. They put Europe at a disadvantage compared to the US and China. A cost-neutral shift of electricity taxes and levies would boost competitiveness and energy security.

Wind energy is set to become the leading source of electricity in the EU before 2030. The EU wants wind to cover 35% of electricity consumption by 2030 and more than 50% by 2050.

Wind energy is affordable, scalable, clean and home-grown. It cuts energy costs for European businesses and households while boosting energy security and predictability compared to fossil fuels.

Despite the clear benefits of renewable electricity over fossil fuels, Europe’s electrification efforts are stalling. In the EU only 31% of industrial energy use comes from electricity.

Electricity could deliver much more. 74% of industrial energy use could be electric with technologies already available on the market such as electric arc furnaces for steel. Another 14% could be electrified by 2030 and 5% more by 2035 leaving just 7% of processes that remain for now non-electrifiable.

Europe needs to ramp up electrification. Many industrial processes are ready to be electrified, especially those that run on low process heat. This includes paper, pulp, food & beverage and chemicals. But also more energy-intensive processes like steel manufacturing. Europe can make big changes here quickly – and give a real boost to its industrial competitiveness.

New report: Taxes and levies undermine electrification

A new report released at the WindEurope Annual Event in Copenhagen today highlights that high electricity taxes and levies are a drag on industrial electrification. This is in part because electricity taxes and charges pay for things that are completely unrelated to energy.

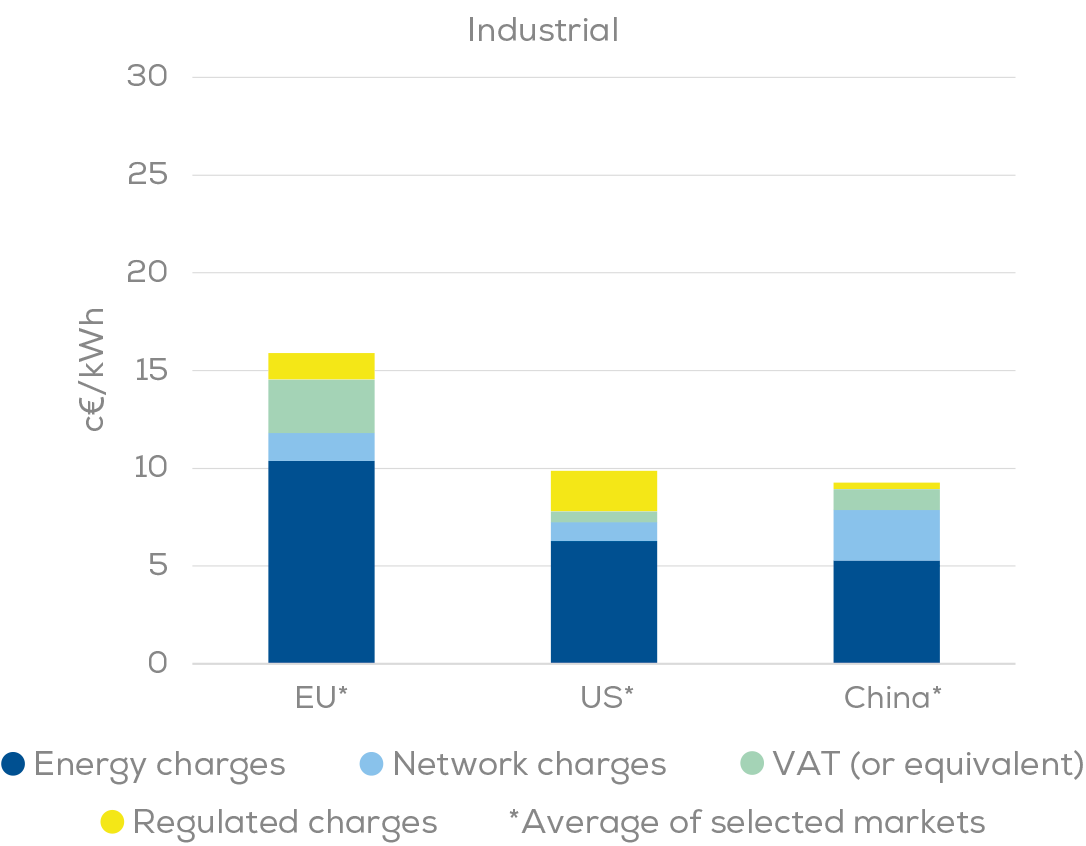

European industry pays significantly more in electricity taxes and levies than in the US and China. Country-by-country analysis shows that regulated electricity charges for industry are 4 times higher in Europe than in China.

And despite the urgent need to shift away from imported fossil fuels, electricity is taxed more than gas across Europe. In Poland, for example, industrial electricity charges are twice as high as for industrial gas.

“Renewables have helped cut wholesale electricity prices across Europe. But households and businesses still pay too much. That’s due to high taxes and extra regulated charges that remain part of our bills. Many of these should not be tied to electricity use but move to general taxation.” said Vasiliki Klonari, WindEurope Director for Energy System Integration.

In many countries, energy-intensive sectors that are typically hard to electrify benefit from lower regulated charges and exemptions from network costs. But the complexity of getting these exemptions often outweighs the benefits of paying lower charges. Those industries that are ready to electrify typically face much higher regulated charges than energy-intensive sectors.

ELECTRICITY TAXES AND LEVIES IN SELECTED COUNTRIES. SOURCE: VAASAETT

In all countries a big share of regulated charges on electricity bills fund measures that aim at the decarbonisation of the economy, security of supply and energy efficiency. Today these costs are borne mainly by electricity consumers. And go to things that undermine Europe’s energy objectives. Since the Green Deal, Europe has spent €364bn on fossil fuel subsidies. These costs must be shared more equitably with all energy users or taxpayers, and targeted at what will deliver energy security.

“European industry wants to run on electricity. Making the necessary investments happen isn’t just about Government support, we need to fix the electricity bills too, so industry pays the right price. Right now, the deck is stacked against electrification: it’s simply not right that charges on electricity are higher than on gas”, says Pierre Tardieu.

5 recommendations to revamp electricity charges

The report provides 5 recommendations to reform regulated charges on electricity and make electricity more affordable:

- Reduce regulated charges on electricity to a minimum.

- Remove non-energy-related charges.

- Shift renewable support and capacity charges to general taxation for better oversight of energy spending on energy security, affordability and decarbonisation. These bring wider economic benefits and should not be tied to electricity consumption.

- Reduce regulated charges for ready-to-electrify industries – even if non-energy intensive.

- Keep on the electricity bills the grid development and operation charges tied to consumption to promote efficient electricity system use.

The report was launched at WindEurope’s Annual Event in Copenhagen. The event gathers over 15,000 people on 8-10 April in a conference and exhibition. BalticWind.EU is media partner of the WindEurope annual conference in Copenhagen.

Source: WindEurope