The following text is published courtesy of the author Benjamin Wehrmann and the Clean Energy Wire website.

Author: Benjamin Wehrmann, Clean Energy Wire

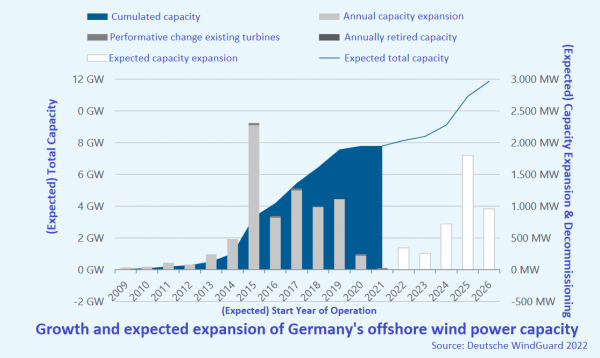

Offshore wind power has been the last of several renewable power technologies rolled out at a large scale in Germany’s energy transition but has shown its ability to catch up quickly. While investors initially shied away from the high investment costs and risky working conditions, price drops and technological advancements have made offshore wind increasingly attractive and it now ranks among the cheapest forms of producing renewable power. But even though reliably strong winds at sea have shown offshore turbines could make a significant contribution to reaching Germany’s climate targets, offshore capacity expansion has come to a complete standstill in 2021 and only slowly picks up again amid the renewables push initiated by the government that took over at the end of that year.

Quick facts

(Figures for mid-2022, end of 2021; Sources: BWE, BWO, Fraunhofer ISE, WAB)

Number of turbines installed: 1,501

Total capacity installed: 7.8 GW

Projected expansion: 30 GW (2030)

Share in net power production: 4.9 %

Output: 24 TWh

Employees: ≈21,400 (2022)

Average auctioned support level: 4.66 ct/kWh (2018)

Offshore wind power is a relatively young industry branch in Germany. While experience in onshore wind power generation dates back to the early 1990s, the country’s first offshore wind farm started test mode only in 2009. During the decade that followed, the technology underwent rapid growth in Germany and several other countries. As of early 2022, there were about 1,500 turbines with a capacity of nearly 7.8 GW in operation in German waters in the North Sea and Baltic Sea.

Despite Germany only having a comparatively small sea area available for offshore wind, the technology now is seen as a key ingredient energy transition plans thanks to support-free projects and very reliable power production capabilities. And yet, the country added not a single new turbine in 2021 – and also not in the first half 0f 2022.

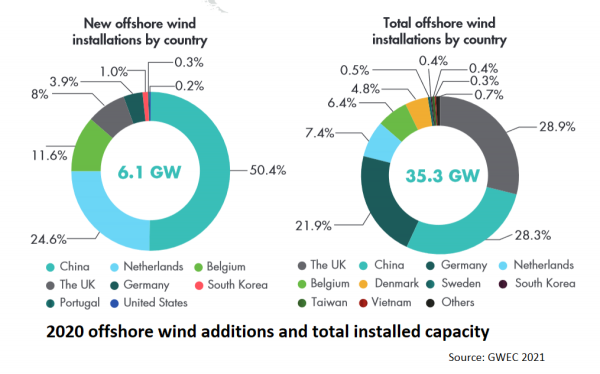

Still in 2017, turbines installed in German waters accounted for roughly 40 percent of worldwide capacity making it the second-biggest offshore wind power market in the world after the United Kingdom. However, it was since surpassed by China.

Offshore wind’s contribution to Germany’s power production mix reached nearly five percent in 2021, a significant increase from merely 0.1 percent in 2014. The cumulated offshore capacity of 7.7 GW provided over 24 terawatt hours (TWh) of electricity in 2021 and the new government has set the ambitious goal of achieving a capacity of 30 GW by 2030.

The revised expansion goal introduced by the government under chancellor Olaf Scholz after its inauguration at the end of 2021 goes fary beyond the 20 GW set by the previous administration and is part of its overall aim to bring the share of renewables the power mix to 80 percent by the end of the decade. Persistent drops in offshore wind costs and the turbines’ high and reliable yield have bolstered confidence that the technology can become a pillar of the power system. According to research institute Fraunhofer IWES, Germany could potentially install up to 54 GW of offshore and generate nearly 260 TWh of electricity at sea.

With an average capacity of 5.1 megawatts (MW) for new turbines and an average rotor length of 133 metres in 2021, offshore turbines have not only grown significantly since their introduction in the early 2000s but are also bigger and more productive than turbines operating ashore. They deliver power almost all year round and produce nearly twice as much power as land-based turbines, says offshore service company Deutsche Windguard. The growth in size and output played a key part in bringing down power generation prices in recent years.

Unbalanced distribution and persisting grid challenges

The vast majority of Germany’s offshore turbines are located in the North Sea, with about 6.7 GW installed off Germany’s western coast, compared to just 1.1 GW in the Baltic Sea in the East. Wind yields on average are much higher in the North Sea than in the Baltic, attracting investors with higher returns. Also future expansion is therefore set to take place primarily in the North Sea, the region where other projects by the UK, Denmark, the Netherlands, Belgium and Germany together have created the largest offshore wind power cluster in the world.

A 2019 study by energy policy think tank Agora Energiewende* found the amount of energy offshore turbines are able to generate falls considerably if farms are located too close to each other. In order to spread turbines more evenly in German waters, the government has set a quota for projects in the Baltic Sea in offshore wind power auctions.

Lower Saxony, Germany’s northwestern federal state on the North Sea, which also hosts most of Germany’s onshore turbines, was home to well over half of all German offshore wind farms in 2021. Schleswig-Holstein, the northernmost state that borders both the North Sea and the Baltic, boasted about one third, while northeastern Mecklenburg-Western Pomerania on the Baltic had about 15 percent of installed capacity.

The clustering of power generation capacity in northwestern Germany creates challenges for providing sufficient grid capacity to transmit large volumes of electricity produced centrally in a small area. Lacking grid connection from the sea to the mainland in the industry’s early days led to a situation mocked by critics in which turbines had to be powered with diesel generators to prevent corrosion and other damage. Regular operation of the turbines was not possible since these produce much more electricity than what is needed to power them up while the surplus could not be disposed of. However, this sort of problem largely appears to be a thing of the past, as none of the turbines in 2021 lacked a grid connection, industry organisation BWO said.

The existing grid in that year had a capacity of 8.2 GW, with more connections already under cosntruction. The total connected capacity so far was projected to be 10.8 GW in 2025, but the new government’s push for more offshore power means that the schedule for linking capacity will have to be revised, the BWO said.

But transmitting power from production sites at sea to the mainland is only one part of the problem. Another and perhaps even bigger challenge is to cover the much longer distance from windy northern Germany to industrial centres in the south, which the Federal Network Agency (BNetzA) has outlined in its offshore grid-development plan.

The major transmission line projects, SuedLink and SuedOstLink, are scheduled for completion by 2025 [See the CLEW dossier on Germany’s power grid for background]. However, constant opposition from both local residents and lawmakers to the large-scale infrastructure projects that run hundreds of kilometres through the country has put this timeline in danger.

Artificial island plans and a cable to Norway testify to offshore dynamic

The ambitions to maximise the German North Sea wind’s output do not end in Germany. Transmission grid operator TenneT, which is responsible for providing the link to the mainland in the North Sea, has planned a power cable that will run some 620 kilometres from German waters to Norway. The so-called “NordLink” cable, which started operation in 2021 with a capacity of 1.4 GW, helps to fill Norway’s hydropower stations using excess German offshore wind power, thereby increasing supply security and price stability in both countries.

Each offshore wind farm has its own substation that bundles the output of all turbines and converts the power produced to a different voltage level. Most German offshore wind farms are built quite far away from the shore compared to projects in other countries to keep them out of sight from coastal dwellers. New installations are built at a distance of some 70 kilometres from the coast and at a depth of 30 to 35 metres, according to the BWO. The generated power is therefore usually converted into direct current on the spot in order to minimise transmission losses before it is transferred to the nearest node on land.

Several European grid operators have proposed to build at least ten artificial “energy islands” as wind power hubs in the North Sea to make use of large-scale offshore wind energy in meeting the continent’s climate targets. According to the North Sea Wind Power Hub (NSWPH) consortium, a possible trans-border offshore grid project between Denmark, the Netherlands and Germany could play an important role in the countries’ energy systems. By removing the need for individual substations at a central location at sea, the islands could substantially reduce costs for offshore wind power installations. Germany and Denmark in 2020 agreed to intensify cooperation on these offshore “energy hubs.”

Other initiatives to better integrate offshore wind power into the joint European power grid include “Eurobar,” a joint project by seven grid operators for interconnecting offshore wind platforms.

Cost drops follow change to support scheme

The wind farms’ distance from the shore and the harsh conditions at sea, where heavy waves and salty water require special equipment and training for deployed personnel and that the used materials be extremely resilient, in the past have been a major deterrent for investors. But constantly high yields as well as the prospect of steep learning curves and associated cost drops have triggered a renewed interest in offshore wind power.

Investors could close funding gaps with financial assistance from German development bank KfW, which funded the country’s first ten offshore projects at customary interest rates. According to the German economy ministry (BMWi), commercial banks were reluctant to finance the pioneer projects as financial risks were hard to gauge. The five-billion euro programme by the KfW was therefore intended to allow daring operators to gather experience and sound out cost reduction potentials.

According to a study by the Hertie School of Governance in Berlin, cost control has made significant improvements in German offshore wind power projects. While the country’s first offshore wind farm, Alpha Ventus, overshot cost projections by some 30 percent, financial planning subsequently became more and more advanced. The average cost overrun for Germany’s offshore wind farms has been around 20 percent, the researchers found, with much of the additional costs due to lagging grid connection. By contrast, nuclear plants have an average cost overrun of 187 percent, the study says.

The German government in 2014 set support rates for offshore wind at 15.4 cents per kilowatt hour (kWh) over a period of 12 years or 19.4 cents/kWh over eight years in order to offer interest advantages for investors. After this period, the support rate paid by customers as a surcharge on their power bill falls to a basic level of 3.9 cents/kWh and ends after 20 years of support.

Guaranteed support for offshore turbines was already gradually decreasing when Germany’s renewable energy support scheme switched to auctions in 2017, a move that was followed by substantial cost reduction results and some operators even announcing to launch projects without any direct support payments at all.

The average support level in the first auction was 0.44 cents/kWh, which according to the German Wind Energy Federation (BWE) has made the cost question much less relevant. In the second auction in April that year, however, average support levels surged to 4.66 cents/kWh, although some bidders again offered to build for 0 cents/kWh. Bids in the latest auction, terminating in September 2022, are capped at 6.4 cents/kWh.

According to industry association AGOW, the higher average support rate is mostly due to the so-called “Baltic quota,” which ensured that projects in the less productive Baltic Sea took precedence over those in the North Sea and led to lower competition, AGOW says.

At the end of 2017, the Netherlands followed suit in producing zero-support bids in offshore wind power auctions. Contrary to the German auction winners, the first Dutch turbines are already slated for completion in 2022, meaning that these would be the first projects to actually operate without subsidies.

Offshore jobs less affected by wind industry worries

As more and more offshore turbines have been built in recent years in the North Sea and the Baltic, employment in this highly specialised industry sector has been on average increasing in recent years. Figures by industry association WAB from early 2022 said that around 21,400 people were directly employed in the industry, generating an annual turnover of 7.4 billion euros. However, employment in the sector would to a great extent depend on poitical decisions, especially regarding projected expansion levels that provide planning security for investors, it added.

While offshore wind creates jobs at bearing, gearing and generator producers across the country, the coastal regions are those benefitting the most from the technology’s rise. Ports on the North Sea and the Baltic, such as Bremerhaven, Cuxhaven and Rostock, are upgrading their capacities to host giant turbine components, foundation systems and mounting equipment. Shipyards and service providers that cater for maintenance and wind farm operating personnel add to those profiting from the expansion boom at sea, the Stiftung Offshore Windenergie says. German North Sea outpost Heligoland, a small island situated some 65 kilometres offshore, is hoping to unlock even more offshore wind potential by taking part in the expected green hydrogen boom, which could allow producing the storable renewable fuel with offshore turbines on site.

Siemens Gamesa, Germany’s largest turbine maker, was formed by a merger between the wind power branch of German engineering heavyweight Siemens and Spanish turbine manufacturer Gamesa, which according to Bloomberg NEF retained its position as the world’s leading turbine manufacturer in the offshore sector in 2021, although Chinese competitors are catching up quickly.

The switch to auctions in Germany’s renewables support scheme has compounded cost pressure for turbine makers, which already caused companies like Nordex and Senvion to lay off staff. Siemens Gamesa said it also needs to cut jobs internationally due to a fall in global revenue. However, according to a survey among employee representatives by labour union IG Metall, jobs that are focussed on the offshore sector will be less affected by the companies’ austerity plans. Most of those surveyed say the prospects for offshore wind are better than those for the German wind power industry as a whole.

But despite the rather comfortable current situation in the offshore industry, local politicians and industry representatives are calling on the federal government to ramp up its offshore plans due to the technology’s cost drops and reliable power supply. In their “Cuxhaven appeal”, lawmakers from northern Germany and wind power company leaders say rigorous support of the technology has been responsible for lower prices and is still needed to ensure that Germany exploits the technology’s full potential in order to achieve the Paris Climate Agreement’s emissions reduction targets.

Source and copyright: Clean Energy Wire