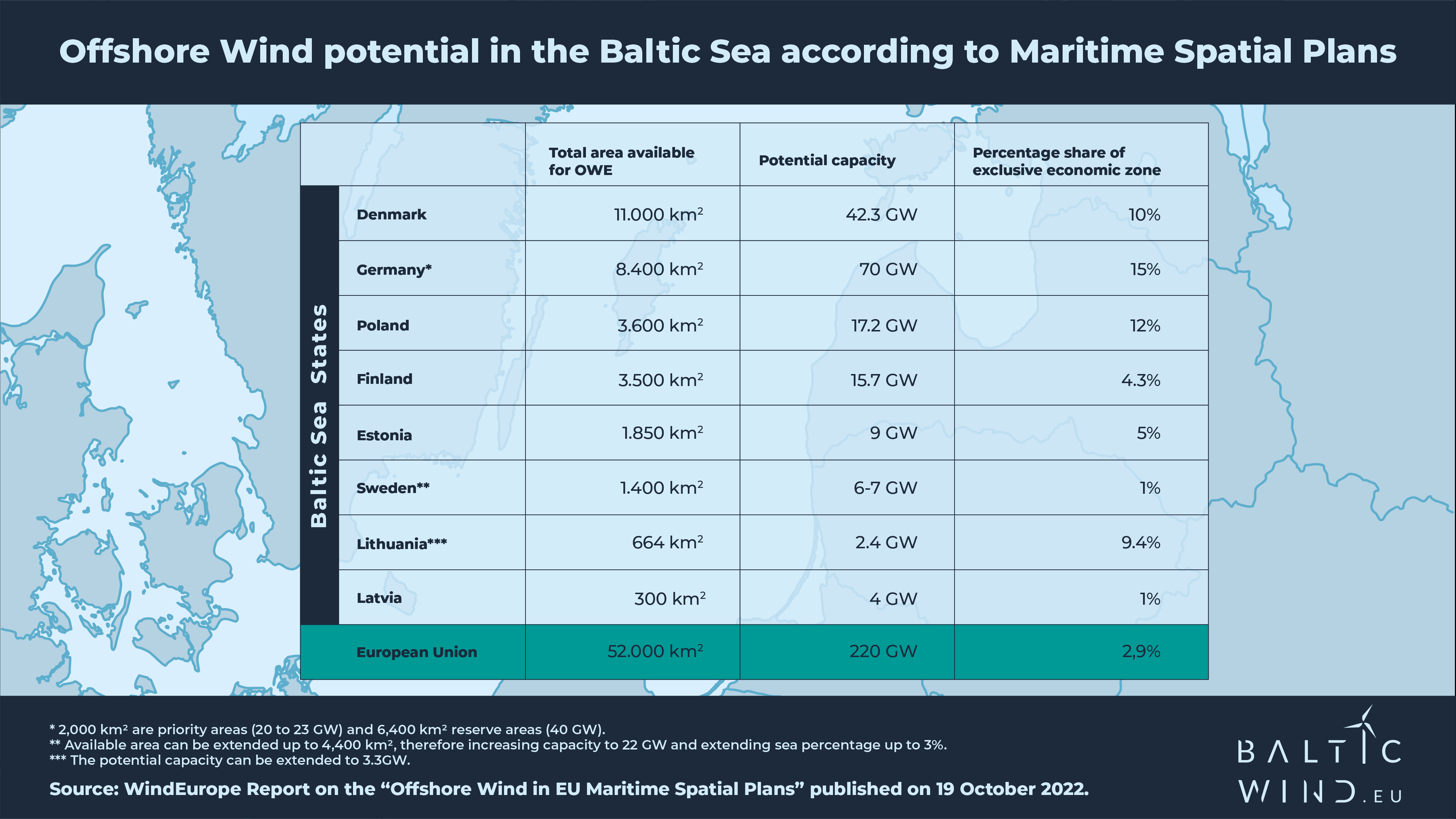

EU countries have earmarked around 52,000 km2 for wind energy development, as shown in WindEurope’s analysis of offshore spatial plans. Such an area, if fully utilized, will allow the installation of 220 GW of wind power. Among the leaders are Belgium and Germany, which together want to allocate 15% of their territorial waters for wind farms, followed by Poland, which plans to invest in 12% of the exclusive economic zone (EEZ). In contrast, Estonia, Finland, Latvia and Sweden plan to designate less than 5% for offshore.

The EU’s Maritime Spatial Planning (MSP) Directive, adopted in July 2014, obliged coastal member states to designate sites for offshore investment to meet ambitious energy transition plans by 2030. In its analysis, Wind Europe summarized the latest versions of the plans prepared by EU countries.

Among the Baltic states, Germany leads the way, with MSP plans to allocate about 8,400 square kilometerskm2 of which 2,000 km2 is a priority area and 6,400 km2 reserve areas. The total is expected to allow investments of 70 GW. Some of the designated areas are adjacent to nature reserves, but the investments are to remain without any negative impact on the environment.

Poland has earmarked 3600 km2 for offshore wind farms, which is 12% of its territorial waters. The total is expected to yield 17.2 GW, almost half of which, 8.4 GW, is already under administrative proceedings. Offshore experts acknowledge that the Polish part of the Baltic Sea has ideal conditions for offshore wind development due to both sea depth and windiness.

Estonia has allocated 1850 km2, which is 5% of the EEZ. That holds the potential for 9 GW of offshore wind energy. Here, the wind speed and seabed, as well as low levels of icing, are also conducive to harvesting wind energy. In addition, the designated areas do not overlap with defense and conservation areas, although they are adjacent to one of the two offshore wind development areas. There may be conflicts with shipping due to shipping lanes.

Finland has a regional plan developed by coastal municipalities. It is 3,500 km2 (4.3% of its offshore economic zone), which is expected to allow investment in 15.7 GW of power. All areas are planned at least 10 km from the coast.

Latvia expects to invest in 5 areas of 60 km2 each, amounting to a total of 300 km2 (about 1% of the EEZ) and generating 4 GW (each area of 800 MW). All areas are at least 8 km from the coast. They do not overlap with protected areas, although they are adjacent to areas that may have such status.

Lithuania wants to allocate 644 km2 (9.4% of the EEZ) for offshore farms. Government sources say this will yield 2.4 GW, but the potential is much greater and could yield as much as 3.3 GW. Intensive work is currently underway in preparation for the construction of the first offshore wind farm with a capacity of 700 MW.

As much as 10% of the EEZ, or 11,000 km2, has been earmarked for investment by Denmark, with most of the land located in the North Sea. Such an area will enable 42.3 GW by 2050 with 35 GW of new capacity in the North Sea and 5 GW of new capacity in the Baltic Sea. This may have some impacts occurring for seabirds and bats. No negative impacts are expected for marine mammals. Offshore wind power does not overlap with high-value fishing areas, but it does overlap with one NATO training area.

Sweden has allocated areas suitable for the production of 20-30 TWh of offshore energy, and land for another 90 TWh is under study. With an assumed capacity factor of 45%, this means 6-7 GW under the current plan (1400 km2 at 5 MW/km2 = 1% EEZ) and up to 22 GW under additional analysis (4400 km2 at 5 MW/km2 = 3% EEZ).

This offshore development plan is only the first step in accelerating offshore investment. The process itself is extensive and requires widespread cooperation, but it is an important step to increase the use of offshore resource efficiency. As WindEurope’s analysis shows, it is time for member states to set clear targets. This will require preparing a schedule of tenders and establishing a supply chain so as to broaden the field of cooperation and avoiding competition. Cooperation with NGOs, which play an important role in analyzing issues such as environmental protection or socioeconomic impact assessment, also remains a key factor.

Source: WindEurope