The Baltica 9 project, developed jointly with FEW Baltic II as the Baltica 9+ undertaking with a total capacity of approximately 1.3 GW, strengthens PGE Group’s position as a key player in the Polish offshore wind market. Bartosz Fedurek, President and CEO of PGE Baltica, discusses the significance of the auction, economies of scale on the Słupsk Bank, implications for the supply chain, and the main challenges facing the investment.

Krzysztof Bulski: What role does the Baltica 9 project play in PGE Group’s long-term strategy, and how does it complement PGE’s existing investment portfolio in the Baltic Sea?

Bartosz Fedurek: Baltica 9 is an important and well-considered addition to our investment portfolio. Our primary focus is on projects located closest to the shore, characterised by the lowest development costs and the greatest infrastructure resilience. These projects allow us to offer offshore-generated electricity at the most competitive prices.

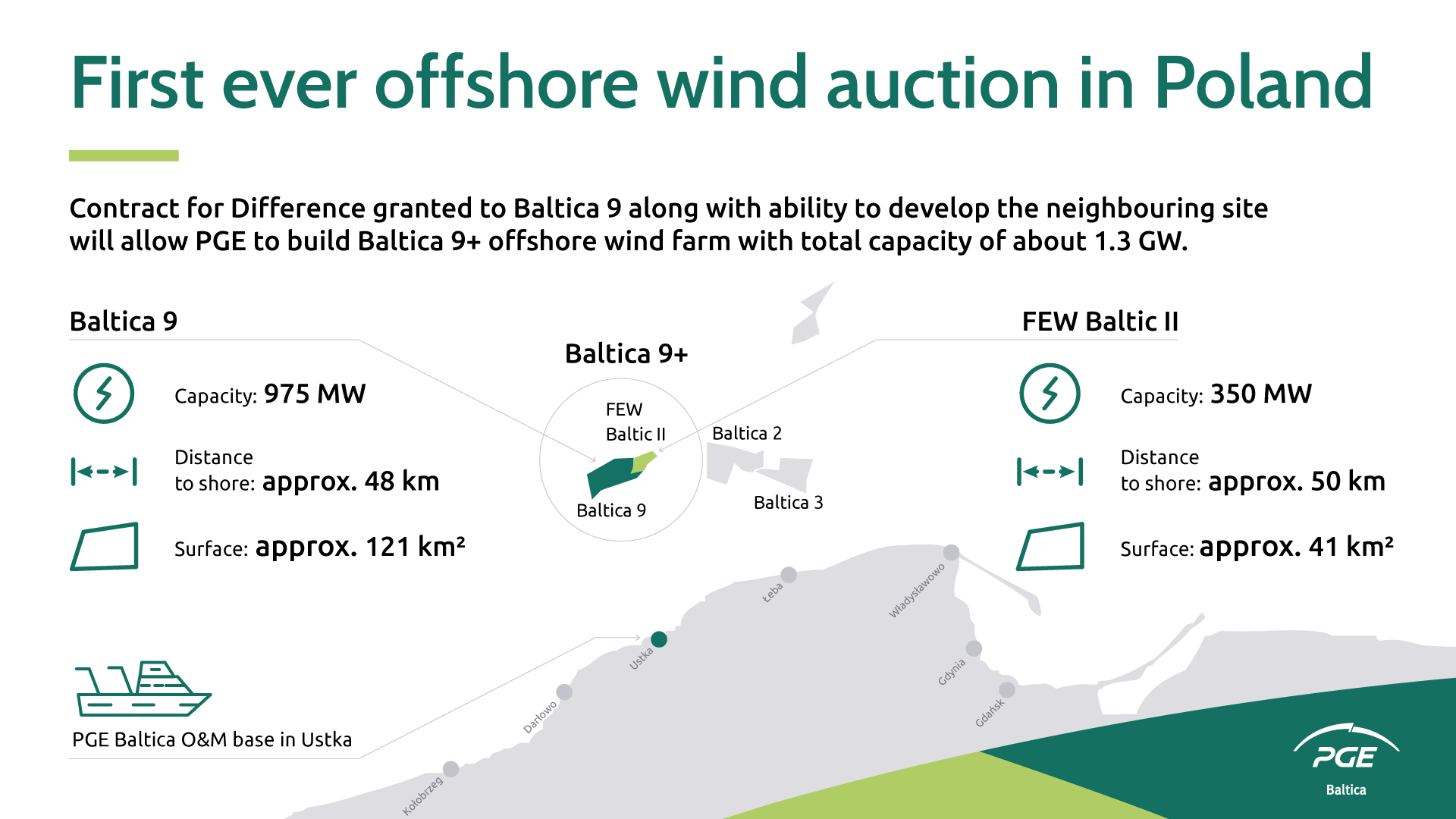

Baltica 9, with a capacity of 0.975 GW, is located in the western part of the Słupsk Bank. It will be developed together with the neighbouring FEW Baltic II project, with a capacity of 0.35 GW from Phase I, for which we have signed a conditional acquisition agreement with RWE, as part of the Baltica 9+ undertaking with a total capacity of approximately 1.3 GW.

By way of reminder, the auction applied three price “zones”: the Eastern Słupsk Bank with a maximum price of PLN 485.71/MWh, the Western Słupsk Bank with a maximum price of PLN 499.33/MWh, and the Central Bank with a maximum price of PLN 512.32/MWh. The Baltica 9 project was contracted at a price of PLN 489/MWh, and taking into account that FEW Baltic II is a Phase I project with a maximum price of approximately PLN 443/MWh, the estimated average price for Baltica 9+ is around PLN 477/MWh (prices expressed in 2025 values).

At the same time, our two key Phase I projects, Baltica 2 (1.5 GW) and Baltica 3 (1 GW), are also located on the Słupsk Bank. In this way, we have built a coherent investment portfolio. In total, this represents more than 3.8 GW of capacity with secured revenue streams, within an area that provides us with the greatest synergies, particularly in operations and maintenance (O&M), supported by the facilities we are developing in Ustka.

This is currently the best and most efficient set of projects we could have created based on the location permits held by PGE. The delivery of these projects will, in essence, fulfil PGE Group’s strategic offshore wind ambitions through to 2035.

The Baltica 9 auction is widely seen as a signal of stability in the Polish offshore market. In your view, how will this success affect the supply chain (local content) and the confidence of international investors in Poland?

The success of Baltica 9 is very good news for the Polish supply chain. Its development depends on a stable, reliable and consistently delivered domestic project pipeline, and this is precisely the type of portfolio we are co-creating today. The Baltica 9 project, or more accurately Baltica 9+, is an investment with solid economic fundamentals, and therefore a high level of predictability and delivery certainty. In 2026, we will begin the contracting processes for key technological components and construction-phase services. Our objective is clear: we want to award as many of these contracts as possible to Polish companies.

As for international investor confidence in Poland, the success of the December auction is yet another confirmation that Poland is currently one of the most attractive offshore wind markets not only in Europe, but globally. The foundation of this attractiveness is regulatory stability.

The schedule envisaging commissioning of the wind farm by 2032 is ambitious. What are currently the main technological or regulatory challenges standing in the way of timely delivery of this investment?

Polish regulations provide that a generator winning an auction has seven years to complete the development phase, construct offshore and onshore infrastructure, and obtain a generation licence. Given the scale and complexity of offshore investments, this is an ambitious but achievable timetable. The key challenge will be the effective contracting of critical technological components and services. Effective in the sense that it enables financial close and the timely taking of the final investment decision (FID), which marks the start of the construction phase.

We must also remember that the global offshore wind market is currently undergoing a period of correction and recalibration following a phase of excessive and overheated growth. We believe these processes will be favourable for projects developed in Poland, but at the same time they are not fully predictable, which naturally entails a certain level of risk. As a result, the entire investment process will require an excellent understanding of market conditions, both on the part of PGE Baltica as the investor and across the supply chain, so that the project can ultimately be delivered on schedule and successfully completed for all stakeholders involved.

The acquisition of the FEW Baltic II project from RWE attracted significant attention. How will the decision to develop the project independently affect the pace of work and PGE’s operational flexibility at this location?

Let me reiterate that FEW Baltic II will be developed together with Baltica 9 as part of the broader Baltica 9+ undertaking with a capacity of approximately 1.3 GW. This approach allows us to leverage economies of scale and natural synergies across both the construction and operational phases of the two sites. It is worth noting that FEW Baltic II had, for some time, remained in a state of “hibernation”, without a clear path towards further development. Incorporating it into our portfolio and linking it with Baltica 9 has fundamentally improved its position and economic viability. This gives us greater operational flexibility in this location and greater confidence that both projects will be delivered to the benefit of the system, investors, and the Polish supply chain.

Thank you for the conversation.